Courses

The extensive range of courses offered by I.VW at bachelor’s, master’s and doctoral level enables more than 700 students per year to acquire comprehensive knowledge and skills in risk management and insurance. As part of the public lecture series, the I.VW also offers courses for interested parties who are not HSG students.

Theses

I.VW research topics are often the starting point for bachelor’s and master’s theses. We invite you to search our website for current topics in the field of risk management and insurance.

Bachelor’s and master’s theses are of high practical relevance and address important Basic Research problems. Some of the theses are also carried out in direct cooperation with companies. We are open to proposals for theses in cooperation with financial services companies on suitable topics. The best master’s thesis of each year is awarded the Dr. Hans Kessler Prize.

Current topics for bachelor’s and master’s theses are in the following areas, for example:

– Asset Management in Insurance

– Behavioral Insurance

– Evaluation and management of financial guarantees

– Customer Value and Customer Equity

– Dynamic Financial Analysis and Asset Liability Management

– Emerging Risks

– IFRS 4 and Fair Value Accounting

– Innovative Business Models in the Insurance Industry

– Innovative Reinsurance Solutions

– Capital Allocation and Risk-Adjusted Performance Measurement

– Management of Longevity Risks

– Microinsurance

– Pricing Models for Insurance Risks

– Private Retirement Provision

– Product Innovations in the Field of Alternative Risk Transfer

– Risk Theory and (Life) Insurance Mathematics

– Solvency II and Swiss Solvency Test (SST)

– Sales Control and Claims Management

– Value-Oriented Management of Insurance Companies

Please visit the websites of each professor for contact details and current research topics.

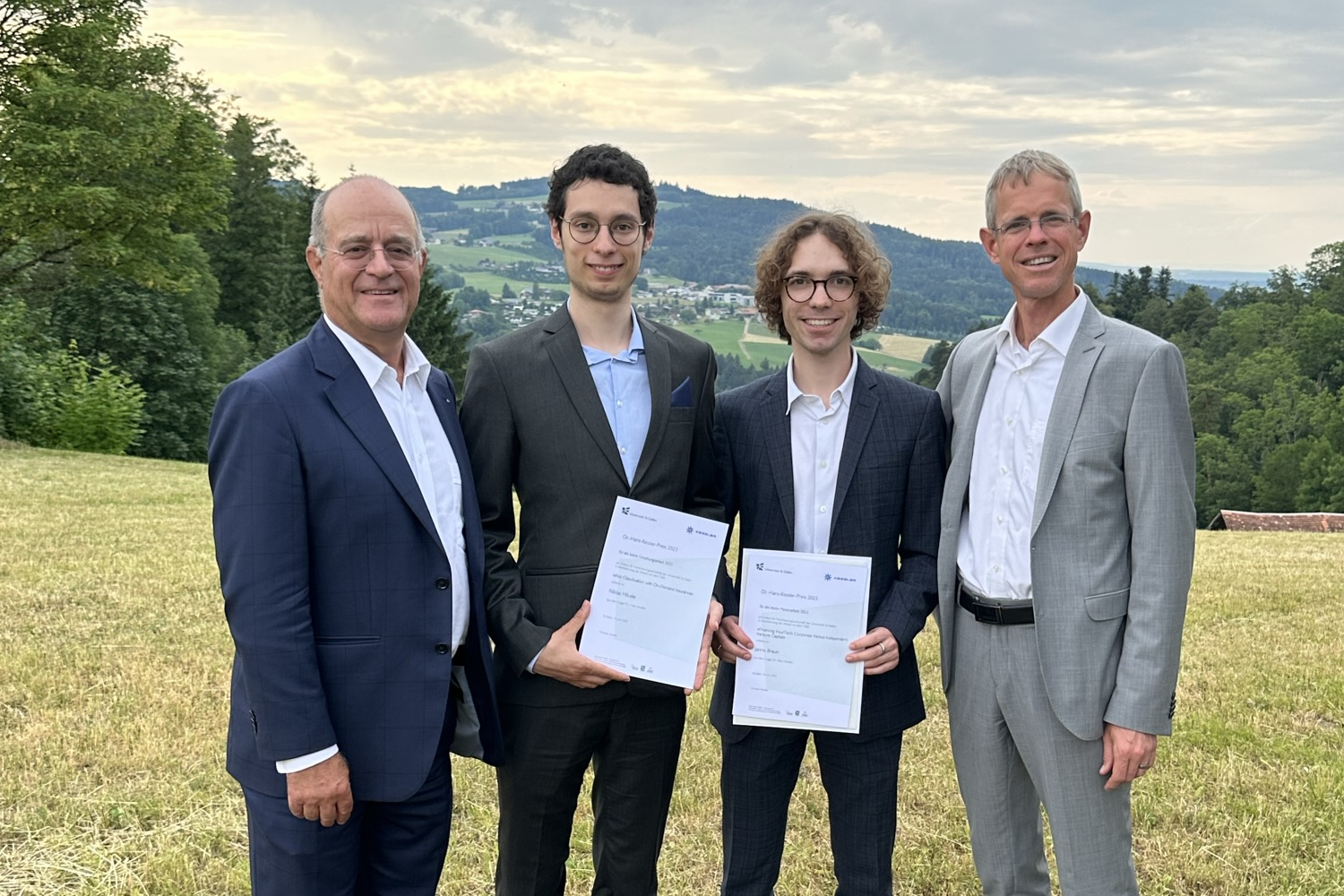

Dr. Hans Kessler Award

The Dr. Hans Kessler Award for the best Master’s thesis in the field of risk management and insurance is presented annually at the I.VW general assembly in June. The following list shows the winners of the past years:

The prize is part of an extensive legacy to promote teaching and research in the field of risk management and the insurance industry, which was generously donated to I.VW by the Kessler family in memory of Dr. Hans Kessler (KESSLER & CO AG, Zurich).